https://www.moneycontrol.com/news/business/markets/a-ferocious-bull-market-awaits-market-leadership-to-see-major-shift-ridham-desai-5299181.html

Last Updated : May 22, 2020 09:08 AM IST | Source: Moneycontrol.com

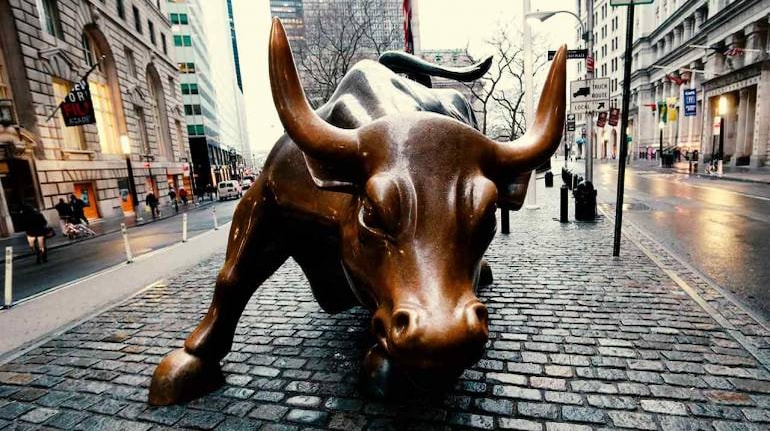

A ferocious bull market awaits, market leadership to see major shift: Ridham Desai

Desai pointed out that COVID-19 has evinced a very strong fiscal and monetary response the world over and it is quite unprecedented as the world has never seen such a response.

When the COVID-19 outbreak comes under control and all the government stimulus starts to kick in, the world will see a ferocious bull market, said Ridham Desai, Managing Director at Morgan Stanley India in a chat with CNBC-TV18.

Desai pointed out that COVID-19 has evinced a very strong fiscal and monetary response the world over and it is quite unprecedented as the world has never seen such a response.

"Even during World War II and in the aftermath of it, we did not see coordinated policy response either across geographies or across agencies. It is multiple times more than the stimulus that was put after the global financial crisis of 2008-09. When we come out of this, all the stimulus waiting to kick in, it is going to create a ferocious bull market around the world," Desai said.

"An unprecedented stimulus has been put in place that is waiting to find its way into the market as well as the economy once the confidence returns. What is required is essentially some comfort that the worst of COVID-19 is over, or more appropriately, we have a vaccine or a cure. So, when the world starts sensing that we have the cure, I think money is going to move into the asset markets," Desai added.

Desai, however, added that he cannot time it as it will depend on how COVID-19 progresses.

Talking about government stimulus, Desai said the jury is out on it.

"The phrase that I have heard from various government sources is that the fiscal package is focussed on affordability and not on need. And that is what we have seen. The government has conserved the fiscal room maybe with two things in mind- one, it saves some bullet for firing later on and two, it actually conserves India's macro stability which is also as important as stimulating growth," he said, adding, "if you assume for a moment that COVID-19 has not had such as the big impact on India than this strategy may end up working."

As the lockdown is creating a lot of pain, Desai is of the view that the biggest stimulus is to come out of the lockdown which is happening right now.

"We are, without making a great fuss about it, slowly walking out of the lockdown. Over the course of the next 2-3 weeks, if we can bring large parts of the economy back to working condition then it itself should be good enough to pull India out of this."

Desai emphasised this quarter is a washout and the next quarter will also be not smooth, but the second half of the financial year could be a whole lot better.

As the texture of the market is changing, with money moving from financials into pharma, digital and telecom stocks, Desai said bull markets are created on the back of new sectors all the time.

"In the mid-90s, it was energy, then consumer staples, at the turn of the millennium it was technology. Then during 2003-07, it was the energy that led the bull market in India and then financials. I dare say when financials hit 30 percent of Nifty's market-cap in February, we may have marked the peak in that cycle," he said.

"So, when a new bull market starts, and maybe one has already started, and March 24 was the date when we created the bottom in the market, I think financials may not lead the way and the leadership may shift. It may shift to consumer discretionary to healthcare to energy or telecoms."

Desai has an inkling that the glorious days of financials may be behind us, but he added that does not mean we may not see big rallies in them.

"Particularly what has happened to the financial stocks during the last 4-5 weeks, we should always be prepared for a big rally in them. We are betting on consumer discretionary, followed by healthcare and to some extent energy to lead the next bull market," he said.

Desai pointed out when a sector's leadership ends, the performance in that sector narrows so in the financial space the action maybe only in the top few names.

Consumption stocks such as PVR and Jubilant FoodWorks have fallen a lot and concerns are being raised that even though there might be pent-up demand, the way we approached things earlier would be different after COVID-19. So, what part of consumption discretionary would lead the rally?

Desai does not agree to the opinion that consumer behaviour will see a shift in India.

"India has come away relatively unscathed by COVID-19. As a consequence, I do not see a permanent shift in consumer behaviour. So, as the companies open up and as things go back on stream, I think consumer behaviour will revert to the way it was," he said.

"A lot of these businesses that have been affected by the lockdown and social distancing will come back. They may not come back together and there may be some gaps. Some may come back immediately, some may take 3-6 months and some may take even a year. But a permanent shift in behaviour is unlikely. I do not see disruption caused by COVID-19 persisting more than 6-12 months," he added.

No comments:

Post a Comment