Bank credit growth to hit a multi-decade low of 0-1%

- Covid-19 pandemic

- Loan

- CRISIL Ratings

- Ratings

- Covid-19

- Press Release

June 08, 2020  Mumbai

Mumbai Bank credit growth to hit a multi-decade low of 0-1%

That will be ~800 bps lower than the 8-9% growth expected before the pandemic

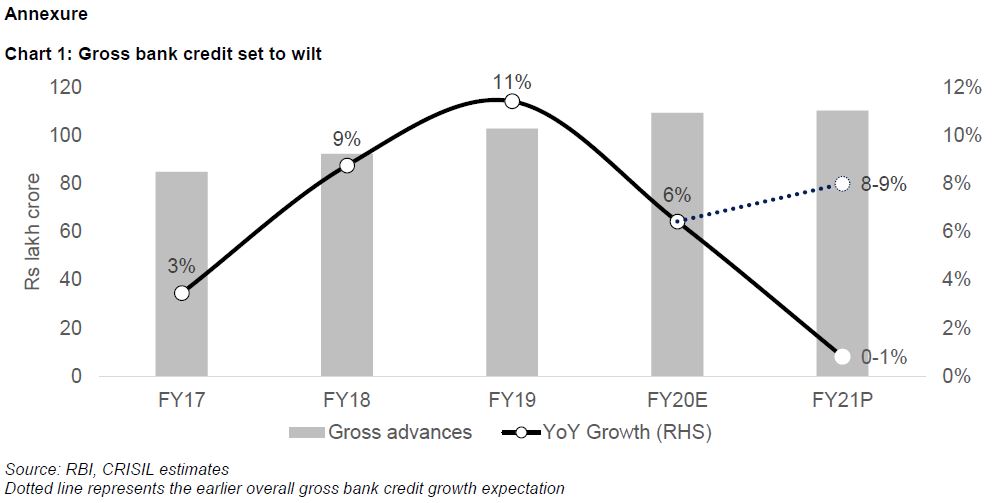

With economy activity sharply impacted by the Covid-19 pandemic, bank credit growth will likely nosedive to a multi-decade low of 0-1% this fiscal (see Chart 1 in annexure), down from an estimated 6% in the last, a CRISIL estimate shows.

This is in sharp contrast to CRISIL’s earlier expectation of 8-9% credit growth before the pandemic struck (refer to our press release titled, ‘Bank credit growth set to bottom out, rise 200-300 bps next fiscal’, dated February 25,2020).

In other words, the impact of the pandemic on credit growth will be a whopping 800 basis points (bps).

The forecast presumes a base case scenario of gross domestic product contracting 5% this fiscal (refer to our report ‘Minus Five’, released May 26, 2020).

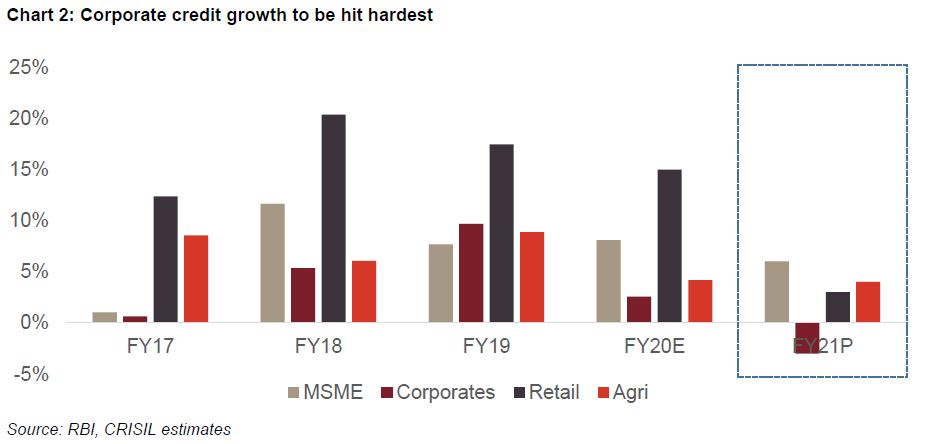

Says Krishnan Sitaraman, Senior Director, CRISIL Ratings, “This crisis is unprecedented and so will its economic fallout be – such as lower capex demand as well as lower discretionary spends, to name some – which will slow down credit offtake significantly across segments in the current fiscal. The corporate loan portfolio, which constitutes almost half of total credit, is expected to be the worst-hit, and de-grow this fiscal. The lockdown has led to significant disruption in operations with limited capacity utilisation across sectors.”

Retail lending, which is about a fourth of overall credit and was holding fort so far, is also expected to slide amid job losses and salary cuts that will lead to reduced expenditure on discretionary items. Purchase of new homes and vehicles are expected to be delayed, impacting demand for financing. Disbursements across most asset classes will see a significant decline this fiscal.

Consequently, overall growth in retail loans is also expected to fall sharply to low single digits this fiscal, compared with average growth in the mid-teens over the past couple of years (refer to Chart 2 in annexure).

Despite the decline in disbursements, credit growth will be positive on account of lower repayments during the moratorium and capitalisation of interest accumulated.

However, the remaining one-fourth of the overall credit pie – comprising micro, small, and medium enterprises (MSMEs) and agriculture – offers some solace.

MSME loans are expected to grow the most at 6-7% this fiscal, riding on the government’s stimulus package – particularly the Rs 3 lakh crore Guaranteed Emergency Credit Line – and are likely to be driven by public sector lenders.

Agricultural loans will likely grow 3-4%, supported by expectations of a normal monsoon and faster recovery in rural India from the pandemic.

Overall, however, given the expected economic contraction – the first time in four decades – the banking sector is expected to witness one of its slowest years.

Says Subha Sri Narayanan, Director, CRISIL Ratings “The uncertainty has led to increased risk aversion among lenders. While the Reserve Bank of India has been reducing policy rates and the government has introduced measures to encourage lending, banks continue to be risk-averse, as reflected in higher surplus liquidity parked with the central bank and the high credit spreads for most borrowers. Therefore, boosting lender confidence through specific sectoral measures that can allay their concerns and lead to efficient transmission of rates and funding, is an imperative to enhance credit growth.”

That said, given our expectation of a gradual economic recovery and the base effect of the current fiscal, credit growth could improve to high single digits in fiscal 2022.

Mumbai

Mumbai

No comments:

Post a Comment