ICICI Direct sees Nifty at 17,500 and Sensex at 58,300 by FY23

The Nifty has rallied over 13 percent in 2021, while the Sensex rose by about 10 percent in the same period, with potential for another 10 percent upside by FY23, says the brokerage firm.

Indian markets have remained resilient and scaled new highs in recent days amid encouraging corporate earnings in Q4FY21, led by the upswing in key commodities prices and strong underlying demand prospects.

The goods and services tax (GST) collection at Rs 1.02 lakh crore for May 2021, the eighth consecutive month of the figure topping the Rs 1-lakh crore-mark, is a testimony to robust domestic macroeconomics.

“Going forward, with a peak of the Covid resurgence behind us, increasing pace of vaccination domestically and calibrated state-specific unlocking underway, we expect economic activity to bounce back sharply in 9MFY22E,” ICICI Direct said in a report.

The view is further reinforced by the step-up Capex by the government that will create a multiplier effect on the economy, it said.

“We expect the present broad-based up move in markets to continue, with small cap and midcaps leading the gains,” said, Pankaj Pandey, Head, Research, ICICI Securities Ltd. Pandey wrote the report.

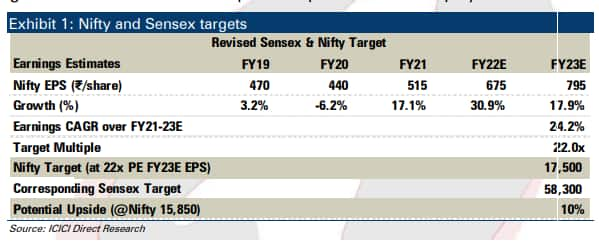

Post Q4FY21, the domestic brokerage firm upgraded earnings estimates to around 7.5 percent with Nifty EPS now expected to grow at a CAGR of 24.2 percent in FY21-23E to Rs 795 in FY23E.

“Assigning the same PE multiple of ~22x to FY23E earnings, our resultant Nifty target is at 17,500 with equivalent Sensex target at 58,300, offering a potential upside of around 10 percent,” the report said.

The traditional PE multiple matrix holds little relevance due to constant change in the index constituents in favour of new-economy stocks as seen by the recent inclusion of Tata Consumer Products against the exclusion of Gail.

Which sectors are looking attractive?Earnings in the oil and gas space were a saviour and lifted overall earnings for FY21. ICICI Direct continues to like IT and pharma space as structural plays.

Double-digit earnings growth over FY21-23E will be led by the automobile sector (base effect), capital goods space and index heavy BFSI space, which also includes the insurance sector, the report said.

No comments:

Post a Comment